Cryptocurrency has become all the rage, with new coins and tokens being launched seemingly every day. But it’s not just an online phenomenon – it’s being used by people around the world to buy goods and services in stores and restaurants, to pay back friends, and even in some places to pay your taxes! Because so many cryptocurrency users are tech-savvy individuals who don’t have a lot of experience with taxes in general, you may be wondering if you need to pay cryptocurrency taxes like everyone else or whether you can skip this step entirely.

An Introduction to Crypto Tax

Cryptocurrencies have been gaining in popularity over the past few years. As more people invest in cryptocurrencies, the question of whether or not these investments are subject to taxes has come up. The answer is a little complicated. There are some transactions that may be taxable and others that may not be taxed depending on how you use your cryptocurrency. If you hold onto your crypto assets for more than one year, then any capital gains (gains from selling assets) will not be taxable. However, if you trade frequently for profit, then all profits made from trading cryptos will be considered income and therefore subject to income tax rates as well as potential self-employment tax if you’re considered self-employed under the IRS guidelines.

The other big issue with cryptocurrency taxes is that it’s unclear what country’s government will get access to information on earnings/transactions. For example, would Russia be able to see American citizens’ earnings or transactions just because they live there? It’s unclear at this point what countries would have jurisdiction over taxpayers’ information in such a situation.

How Will the IRS Treat Crypto Investments?

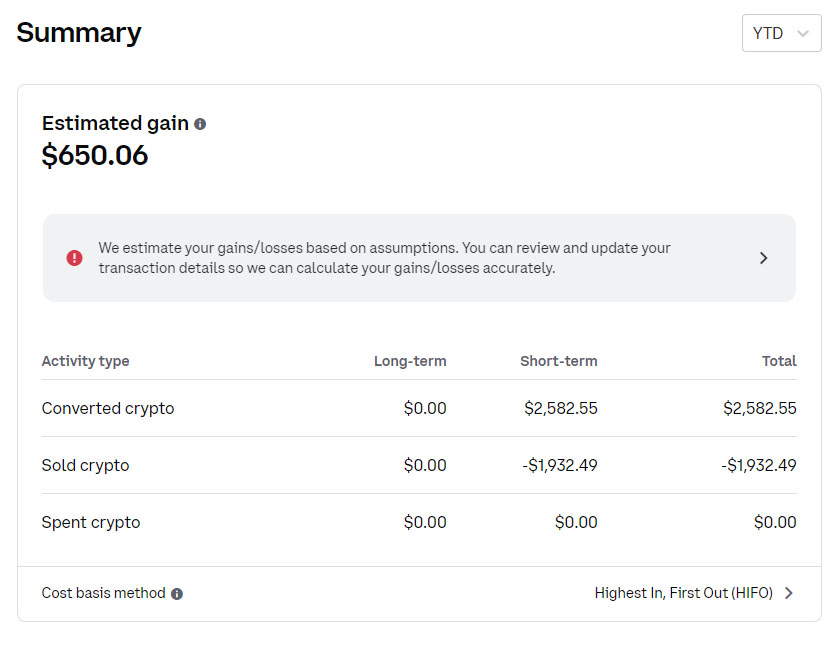

Cryptocurrencies are taxable just like any other investment. The IRS will treat crypto investments as property, which means capital gains taxes will apply. Short-term gains (holdings for less than a year) will be taxed as ordinary income, while long-term gains (holdings for more than a year) will be taxed at the lower capital gains rate. If you’re not sure how to calculate your taxes, there are a number of online tools that can help. If you’re using Bitcoin or Ethereum in day-to-day transactions, it’s best to consult with a tax professional on how to properly account for every transaction. A common practice is to use one wallet for transactions and another wallet purely for investing. Using this strategy helps make tracking easier, but can also lead to confusion when filing taxes. Keep in mind that crypto mining may also generate taxable income if the profits from mining exceed certain limits. Generally speaking, those who mine cryptocurrencies are considered self-employed and are required to pay self-employment tax on these earnings.

Gains from Bitcoin and Other Cryptocurrencies Are Treated as Capital Gains

If you’ve made money from investing in Bitcoin or other cryptocurrencies, you may be wondering if you have to pay taxes on your gains. The answer is yes – cryptocurrency gains are treated as capital gains, and you’ll need to report them on your taxes. Keep records of the date when you acquired each currency, the amount of currency that you bought, and the date when it was sold. These records will help make calculating your gains easier. Depending on how much profit you made, you may also need to fill out a Schedule D form with your tax return. Be sure to consult a tax professional for more information about reporting cryptocurrency transactions.

Tax Tips if You Used a Debit Card, Paid in Cash, or Used Crypto to Buy Goods or Services

If you used a debit card, paid in cash, or used cryptocurrency to buy goods or services, you may be required to pay taxes on those transactions. The Internal Revenue Service (IRS) states that the tax rules for property transactions apply to cryptocurrencies and so some of your gains from trading might be taxable. Gains from mining are also taxable as self-employment income, which is subject to self-employment tax, according to the IRS. Those who use their crypto for personal use do not need to report it on their taxes but should maintain records of such purchases just in case the IRS requests them at a later date. In addition, those who only occasionally trade with cryptocurrencies should keep track of any trades they made during the year because if they have other taxable investments, this will affect the amount of their capital gains. Lastly, taxpayers can take advantage of a new way to calculate cost basis when selling crypto that was announced by the IRS in July 2018.

Tax Tips if Your Crypto Assets Declined in Value

No one likes paying taxes, but if you own cryptocurrency, it’s important to understand the tax implications. Here are a few tips if your crypto assets have declined in value

1) Sell crypto and pay the capital gains on any net profits realized from the sale.

2) Donate any appreciated securities or property and claim a deduction for the full fair market value of what was donated.

3) Buy more securities at their lower price and take advantage of an opportunity to buy low.

4) Keep track of your holdings so that you can deduct them when they eventually go up in value.

5) Consider donating crypto to charity rather than selling the digital currency, which may result in a taxable event.

6) If you’re not sure how to report these transactions, consult with a tax professional.

7) Whether you owe taxes depends on your personal circumstances and should be determined after consulting with your tax advisor.

8) The IRS has issued guidelines on cryptocurrencies, stating that virtual currencies are treated as property for U.S. federal tax purposes.

9) The IRS says if you receive virtual currency as payment for goods or services, then the fair market value of the virtual currency is included in your gross income.

10) If you use Bitcoin to purchase goods or services then those amounts would also be subject to income tax rules governing barter transactions such as retail sales tax and certain state sales and use taxes.

Paying taxes on cryptocurrency can be a confusing and daunting task, but it’s important to stay compliant with the IRS. If you’re not sure whether or not you should be paying taxes on your crypto earnings, talk to a tax professional. They can help you figure out what you need to do and make sure you’re following the proper procedures.